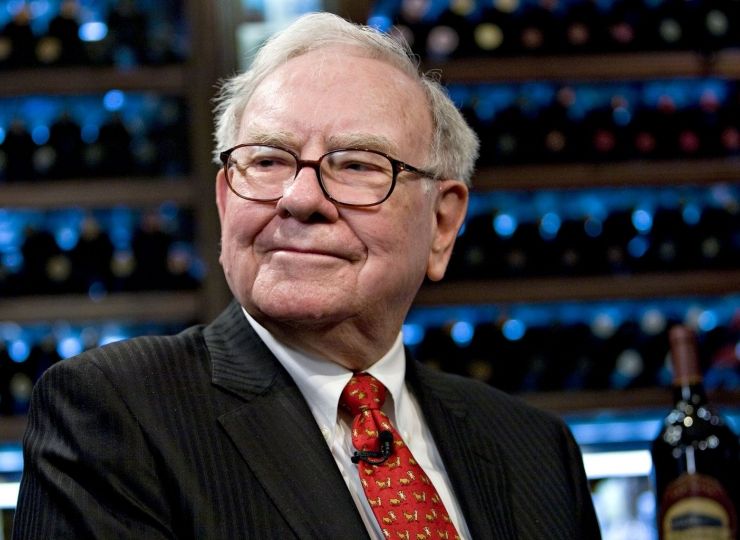

As the year comes to a close, Warren Buffett’s Berkshire Hathaway has continued to increase its stake in VeriSign, a leading provider of internet domain-name registry services.

From December 26 to December 30, the company spent $15.6 million to acquire 76,487 more shares of VeriSign, bringing its total holdings to 13.27 million shares.

The purchases were made through Berkshire’s insurance unit, Geico, which now owns 7.99 million shares, according to a filing with the Securities and Exchange Commission (SEC).

This acquisition strengthens Berkshire Hathaway’s position as VeriSign’s largest shareholder, holding more than 10% of the company’s outstanding shares.

Why Berkshire’s investment in VeriSign is intriguing?

Berkshire Hathaway’s interest in VeriSign has been growing steadily throughout 2024.

The company began purchasing shares in Q1 of the year and has now accumulated a nearly 14% stake in VeriSign.

While the company’s investment has been strategic, Berkshire’s actions stand out as VeriSign has been largely absent from the broader market rally.

Despite the S&P 500 rising by over 50% in the past two years, VeriSign’s stock has remained relatively flat in both 2023 and 2024, struggling to keep pace with market trends.

Buffett’s ongoing purchases of VeriSign shares come in the wake of a broader market recovery, with other Berkshire investments also seeing an increase, including stocks in Occidental Petroleum and Sirius XM Holdings.

In fact, VeriSign stock saw a modest uptick on Tuesday, rising by 2% to $209.03 after a 0.6% increase on Monday.

This marks a significant gain from the prior week, when the stock was up more than 9% in December alone.

VeriSign’s stock performance and why Buffett may have invested in it

Despite these recent gains, VeriSign remains below its record high, which was set in December 2021.

The stock is down about 2% year-to-date and about 21% from its all-time peak.

In terms of market technicals, the stock is currently in a buy zone after recently breaking out above a key price point of $202.74.

This price action, combined with a 73 Composite Rating from Investor’s Business Daily (IBD), shows that there is potential for the stock to recover, though it still lags the broader market.

One reason that might be fueling Buffett’s interest in VeriSign is its impressive profitability.

As of the third quarter of 2024, VeriSign holds the fifth spot in the S&P 500 for the highest profit margins, with a 56% margin, alongside Nvidia.

It also ranks highly for operating and gross margins, which are attractive to long-term investors like Berkshire Hathaway.

The post Why Berkshire Hathaway is betting big on VeriSign in 2025 appeared first on Invezz