Pop Mart’s share price jumped by over 8% on Tuesday, its best performance in five months, as investors cheered its new share buyback program. It rose to an intraday high of H$ 198, up substantially from this month’s low of H$174. It remains 42% below its highest point this year.

Pop Mart share price jumps on a new buyback

The main reason why the Pop Mart stock price rose is that the company announced a big share buyback. It repurchased shares worth $32 million, its first buyback since February 2024.

The share buyback is a sign that the management believes that the company is undervalued. It is also meant to boost the stock performance after it crashed by over 40% from its highest point in 2025.

Analysts believe that the company has more resources to deploy to boost its shareholder returns this year, thanks to the robust Labubu sales in 2025.

Labubu challenges remain

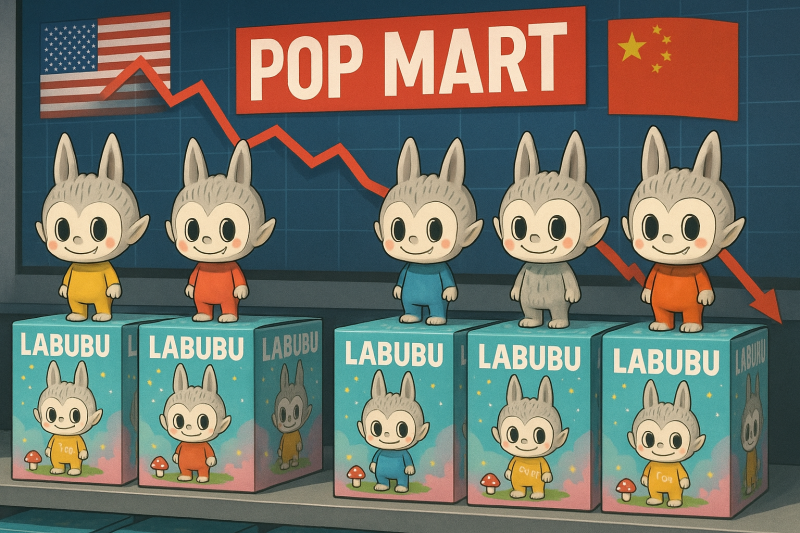

Pop Mart, a popular toy manufacturer, made headlines because of Labubu, a stuffed toy that went viral globally, leading to a surge in sales and its stock price.

The most recent results showed that its revenue surged by 205% in the last financial year to over RMB 13 billion. Its gross profit rose by 234% to RMB 9.76 billion, while the net profit jumped to RMB 4.5 billion, with its net profit margin rising to 33.7% from the previous 21.2%.

The strong revenue growth helped to boost its balance sheet, with the total assets rising to RMB 21.3 billion.

However, the main challenge that the company faces is that there are signs that the Labubu craze is fading. One of these signs is that its sales were disappointing during last year’s Black Friday event in the United States.

Another report by YipitData showed that Labubu’s North American revenue growth slowed to 424% in the quarter to December, much lower than in the previous quarters.

As such, there is a likelihood that Labubu will prove to be a fad similar to Beanie Babies, which became popular in the 1990s only for its popularity to crash.

At the same time, there are lingering concerns on whether its push to the entertainment industry will pay off over time. It opened Pop Land, a large theme park in Shanghai, and is reportedly working with Sony on a Labubu movie.

Also, the company is working on developing other characters and expanding its business abroad. Some analysts believe that all these initiatives will help the stock to bounce back this year. Morgan Stanley analysts wrote that:

“Some profit-taking and short-term correction are normal, but pushing the stock down to trough valuation appears ‘overly preemptive’ — and unjustified.”

Pop Mart stock price technical analysis

Pop-Mart stock chart | Source: TradingView

The daily timeframe chart shows that the Pop Mart stock price has been in a strong downward trend in the past few months.

It formed a giant head-and-shoulders pattern whose neckline was at $233. A H&S is one of the most popular bearish patterns.

The index has formed a descending channel, and the current jump was meant to retest the upper side. It has remained below the 50-day and 100-day Exponential Moving Averages (EMA).

Therefore, the most likely scenario is where the stock continues falling in the near term and then rebound later this year. If this happens, it may drop to the key support level at $150.

The post Pop Mart share price jumps after buyback, but H&S pattern points to a retreat appeared first on Invezz