Asian markets are trading in the green on Thursday, following negative cues from Wall Street after the US Federal Reserve left interest rates unchanged and noted that inflation remains “somewhat elevated.”

Investors reacted to a hawkish Fed policy statement, while concerns persisted over the US administration’s tariff threats and uncertainty surrounding trade and economic policies.

Markets in China, Hong Kong, Singapore, South Korea, Malaysia, and Taiwan remain closed for the Lunar New Year holidays. The closure of the major market lead to thin trading volumes in the region.

The Australian market is trading higher on Thursday, extending gains from the previous session despite Wall Street’s weakness.

The S&P/ASX 200 is above the 8,500 level, supported by gains in mining, energy, and financial stocks.

The index is up 53.70 points, or 0.65%, at 8,500.70 after reaching a high of 8,515.70 earlier.

In Japan, the market is trading modestly higher in choppy sessions after opening in negative territory, continuing its gains from Wednesday.

The Nikkei 225 is moving toward the 39,500 level, with advances in technology stocks partially offset by weakness in index heavyweights and financial stocks.

At the time of writing, the index was up 0.30% to trade at 39,534.76.

Among individual stocks, SoftBank Group is down more than 1%, while Fast Retailing is edging lower by 0.3%. Toyota is up 0.3%, while Honda is down 0.4%.

Media reports suggest that SoftBank is in negotiations to invest between $15 billion and $25 billion directly into OpenAI. If the deal goes through, Softbank would surpass Microsoft as OpenAI’s biggest investor.

Wall Street stocks tumble after Fed pause

US stocks ended lower on Wednesday, giving back some of the gains from the previous session. The major averages recovered from deeper losses earlier in the day but still finished in negative territory.

The Nasdaq declined 101.26 points, or 0.5%, to 19,632.32, while the S&P 500 dropped 28.39 points, or 0.5%, to 6,039.31. The Dow slipped 136.83 points, or 0.3%, to close at 44,713.52.

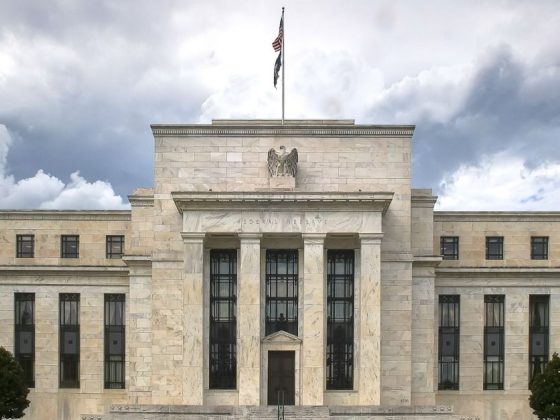

The market’s pullback followed the Federal Reserve’s decision to leave interest rates unchanged after its first policy meeting of 2025, a move that was widely anticipated.

The central bank kept interest rates at 4.25% to 4.50%, maintaining its stance in pursuit of maximum employment and stable inflation at 2% over the long run.

The Fed cited inflation as “somewhat elevated” and reiterated its commitment to bringing it back to its 2% target.

The central bank’s next monetary policy meeting is scheduled for March 18-19, when officials will provide updated projections for interest rates, inflation, and economic growth.

According to the CME Group’s FedWatch Tool, there is a 71.6% probability that the Fed will keep rates unchanged and a 28.2% likelihood of a quarter-point rate cut.

The post Asian stocks rise as US Fed holds rates steady: Nikkei gains 100 points appeared first on Invezz