European stock markets opened flat on Wednesday as investors balanced strong earnings from the continent’s banking heavyweights against the major uncertainty of a looming interest rate decision from the US Federal Reserve.

The pan-European Stoxx 600 index was flat shortly after the opening bell, reflecting a mixed picture across the region.

The UK’s FTSE 100 gained 0.4% and Germany’s DAX edged higher, while France’s CAC 40 and Italy’s FTSE MIB both dipped 0.1%.

The day’s primary driver for global market sentiment is the conclusion of the Fed’s policy meeting.

A quarter-point interest rate cut is widely seen as a foregone conclusion by traders, which would bring the federal funds rate to a new range of 3.75%-4.00%.

The real focus, however, is on the future. Investors will be scrutinizing Fed Chair Jerome Powell’s subsequent comments for any hints of a dovish tilt that would signal further cuts.

According to the October CNBC Fed Survey, market expectations are already high, with 84% of respondents foreseeing another reduction in December and 54% predicting a third in January.

Banking Sector Shines Amid Caution

While caution prevailed ahead of the Fed, positive news from the banking sector provided a bright spot for European markets.

Shares in Deutsche Bank surged 3% after it reported a third-quarter net profit of 1.56 billion euros ($1.82 billion), comfortably beating the 1.34 billion euros that analysts expected, according to LSEG data.

The German bank affirmed that all four of its business divisions are “progressing on their strategic plans.”

Similarly, Spain’s Banco Santander posted a record nine-month profit, up 7.8% year-on-year, pushing its shares 0.3% higher at the open.

The bank credited strong business performance and operational efficiencies for the result. While its third-quarter revenue narrowly missed estimates, its net operating income of 8.99 billion euros slightly overperformed.

The positive report was tempered only by a delay in results from its British subsidiary due to a court ruling on a motor finance scandal.

Big Tech Earnings and Trade Talks on the Radar

Beyond the Fed, investors are also bracing for a busy earnings schedule. Results from US tech giants Alphabet, Meta Platforms, and Microsoft are due after the US close, with their performance considered a key indicator of global economic health.

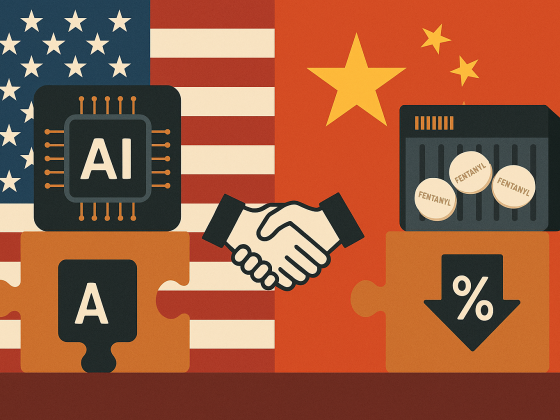

Adding another layer of complexity, traders are monitoring developments in US-China relations ahead of a planned meeting between President Donald Trump and President Xi Jinping on Thursday.

In a potentially positive signal, Trump said Wednesday that he expects to lower tariffs on China linked to fentanyl.

The post Europe markets open: Stocks flat as Fed looms; Santander, DB beat estimates appeared first on Invezz